Is Fall 2025 the right time for investors to (finally) re-enter the Florida real estate market?

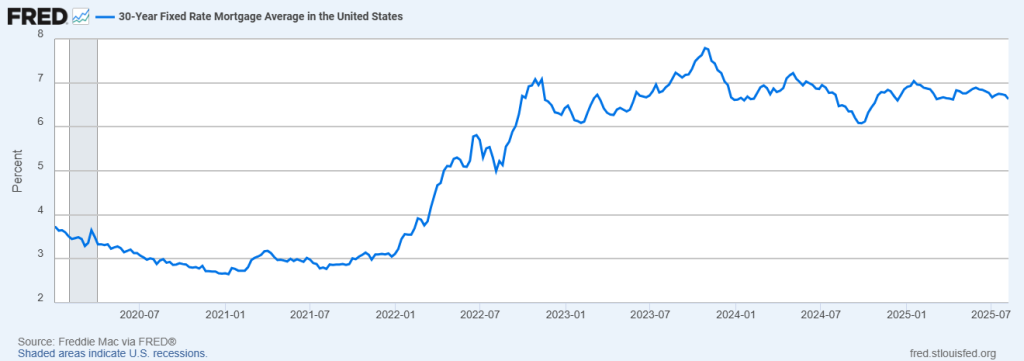

Ask any Florida real estate agent or mortgage broker: Real estate sales and refis have been slow since mortgage interest rates begain to spike in mid-2022. Accordingly, I recall reading an article in November 2022 stating that investment property purchases had declined by 30%. Being unable to make the numbers work on investment property purchases with interest rates at 7 to 8%, many Florida real estate investors stockpiled cash and focused on squeezing more rental income out of their existing properties through strategies such as medium-term furnished rentals.

Fast forward to August 2025, and now apparently real estate investors account for up to 30% of all home purchases. That strikes me as a really interesting data point, and a possible “bookend” to the high interest rate environment we’ve been stuck in for the past three years. But why? Current mortgage rates for investment properties remaing in the mid to high 7’s.

“It seems likely that the financial data to support a drop in interest rates is not far behind the politics. A couple of interest rate drops just in time for the 2026 Spring home buying season could result in a comeback year real estate in 2026, and it appears that savvy real estate investors want to get ahead of that wave!”

Anyone who’s not living under a rock knows that there is currently tremendous political pressure from the Trump administration for the Fed to lower interest rates, and it seems likely that the actual financial data to support a drop in interest rates is not far behind the politics. If that happens, a couple of interest rate drops just in time for the 2026 Spring home buying season could result in a comeback year real estate in 2026, and it appears that savvy real estate investors want to get ahead of that wave.

Which brings us to the old adage: Marry the house; Date the rate.

Translation: Buying a property is a long term commitment (akin to marriage). But you are not committed to your interest rate in the same way; You can always refinance when rates come down.

Will 2026 be a banner year for real estate investing in Florida? Should Florida real estate investors jump in now, get ahead of this wave, and refinance in 6-12 months when rates come down?

No one knows or sure. But there’s another old adage in real estate investing that almost always rings true: The best time to buy real estate was 20 years ago; But the second best time is right now!

Jeff Copeland is a real estate broker, property manager, certified residential contractor (lic #CRC1335463), and owner of Copeland Morgan LLC and Copeland Construction & Restoration LLC in St Petersburg. He is a longtime resident of St Pete and has lived in Venetian Isles since 2023. He offers a full spectrum of real estate, property management, and construction services.

Jeff Copeland is a real estate broker, property manager, certified residential contractor (lic #CRC1335463), and owner of Copeland Morgan LLC and Copeland Construction & Restoration LLC in St Petersburg. He is a longtime resident of St Pete and has lived in Venetian Isles since 2023. He offers a full spectrum of real estate, property management, and construction services.